Despite year-on-year tax rises, company cars remain a popular benefit. While the tax cost of expensive high-emission cars can be eye-watering, by choosing carefully it’s possible to enjoy the convenience that comes with a company car for a relatively low tax cost. So, as the new tax year gathers steam, what’s changed for 2018/19?

The tax charge

Company cars are taxed as a percentage of the list price, which is essentially the manufacturer’s valuation of the car when new. It doesn’t matter how much was actually paid for the car, or whether it was bought second-hand.

It’s the list price that is used to work out the taxable amount and,

where optional accessories are added, the list price is adjusted to

reflect these.

The percentage charged to tax (the appropriate percentage) depends on the level of the car’s carbon dioxide (CO2) emissions. This increases each year, and 2018/19 is no exception. For 2018/19, the appropriate percentage for a car with CO2 emissions of 50g/km or less is 13% (up from 9% for 2017/18), whereas for cars with CO2 emissions in the range of 51 to 75g/km it is 16% – up from 13% – for 2018/19.

For cars with CO2 emissions of more than 76g/km, the charge for 2018/19 is two percentage points higher than in 2017/18 at 19% for cars in the 76 to 94g/km band.

This increases thereafter by 1% for each 5g/km rise in CO2 emission, although there is a maximum charge of 37% which applies to cars with CO2 emissions of more than 180g/km in 2018/19.

The increase in the appropriate percentage means a company car driver will pay more tax on the same company car in 2018/19. When calculating the charge, the list price is reduced for any capital contributions made by the employee (capped at £5,000), while the benefit is reduced to reflect any payments for the private use of the car. If the car is unavailable for part of the tax year, the benefit is proportionately reduced.

Example 1

Tony has a company car worth £30,000 with CO2 emissions of 150g/km, which was available throughout 2017/18. He isn’t due to change his car until July 2019 and pays tax at 40%.

For 2017/18, the appropriate percentage is 29% and the cash equivalent value of the car, on which Tony is taxed, is £8,700. As a higher rate taxpayer, the associated tax bill is £3,480 (£8,700 @ 40%).

For 2018/19, the appropriate percentage has increased to 31%. The taxable amount rises to £9,300 (31% of £30,000) and the associated tax to £3,720 (40% of £9,300).

Although he has the same car, even if it is a year older, Tony pays £240 more in tax as a result of the increase in the appropriate percentage.

Diesel cars

Diesel cars attract a supplement but the nature of that supplement has changed for 2018/19 and beyond.

For 2017/18 and earlier tax years, the supplement was 3%. This increased the appropriate percentage by 3%, compared to that for a petrol car with the same emissions level.

The diesel supplement cannot take the charge above the maximum of 37%. For 2018/19, the diesel supplement increased from 3% to 4% for all cars that aren’t certified to the Real Driving Emissions 2 (RDE2) standard.

The supplement applies to cars registered on or after 1 January 1998, which don’t have a registered nitrogen oxide (NOx) emissions value, and also to cars registered on or after that date which have a registered NOx emissions value that exceeds the RDE2 standard.

While the appropriate percentage is set by reference to CO2 emissions, the new-look diesel supplement is dependent on NOx emissions level.

Under the new rules, diesel cars certified to the RDE2 standard are not subject to the diesel supplement.

In practice, it is unlikely cars on the market before 6 April 2018 will meet the RDE2 standard, with the effect that most diesel cars will be subject to the higher supplement.

Taking into account the increases in appropriate percentages as well, diesel car drivers will suffer a higher tax hike in 2018/19.

Example 2

Maria has a diesel-fuelled company car with a list price of £30,000 and CO2 emissions of 150g/km. Her car doesn’t meet the RDE2 standard but it’s available throughout 2017/18 and 2018/19, and like Tony, Maria is a higher rate taxpayer.

In 2017/18, the appropriate percentage is 32% (normal 29% plus diesel supplement of 3%). This makes the taxable value £9,600 (32% of £30,000) and the tax owed is £3,840 (40% of £9,600).

In 2018/19, the appropriate percentage has increased to 31% and the diesel supplement to 4% – a total of 35%. As a result, the taxable value is £10,500 (35% of £30,000) and the tax bill is £4,200.

The combined effect of the rise in the appropriate percentage and the increase in the diesel supplement means Maria’s taxed £360 more in 2018/19 than in 2017/18 – £120 more than the tax rise suffered by Tony on his petrol car.

Going green

Drivers choosing lower-emission cars are rewarded with lower tax bills.

In the earlier example, Tony paid tax of £3,720 on his company car based on a CO2 emission of 150g/km.

If he had chosen a car of the same value but with CO2 emissions of 40g/km, he would’ve paid tax of £1,560 in 2018/19 (40% (£30,000 @ 13%)) – saving £2,160 a year and £180 a month.

Going electric

Electric cars with zero emissions are charged at the same percentage as cars with CO2 emissions of 50g/km and below – 13% for 2018/19.

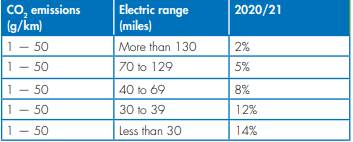

However, from 2020/21 new emission bands will apply to cars with CO2 emissions of 50g/km or less based on the electric range of the car.

This is the maximum distance the car can travel without recharging the battery or using the combustion engine of the plug-in vehicle. Under the new bands, the cars with the greatest range have the lowest appropriate percentage.

The rates for the new bands, which will apply for 2020/21, are shown in the table below. The appropriate percentage is set at 2% for zero-emission cars.

It will pay to go electric, and the opportunity to benefit from a lower tax bill for an electric car should be taken into account when choosing a new company car.

Fuel

A separate fuel scale charge applies where fuel is provided for private mileage in a company car.

This is found by applying the appropriate percentage (as used in working out the taxable benefit of the car) to a set amount. For 2018/19, this is £23,400 – up from £22,600 in 2017/18.

This means that for a car with CO2 emissions of 150g/km, the fuel charge is £7,006 for 2018/19, costing a higher rate taxpayer £2,802.40 in tax – or £233 a month.

Unless private mileage is very high, private fuel is rarely a tax-efficient benefit and where the cost of the car is below the appropriate amount (£23,400 for 2018/19), more tax will be payable on the fuel than on the car.

By contrast, no fuel charge arises if the employer provides electricity for an electric car.

Choosing wisely

The company car tax rules reward those who choose greener cars.

The tax charge on a cheaper, low-emission car is considerably less than an expensive car with high CO2 emissions.

Looking ahead, choosing an electric car will lower the bills still further with a taxable amount as low as 2% of the list price.